Get A $10,000 - $2,000,000 Merchant Cash Advance (MCA) In 2 Hours

Get A New or Consolidate An Existing $10,000 - $2,000,000 Merchant Cash Advance (MCA) And Receive Funds In 2 hours. Pay It Back Monthly, Weekly, Bi-Weekly or Daily. (Eligibility For Term-Length, Monthly Payment and Interest Rate Depends On Term and Credit Profile.) No Collateral Needed. Just Upload This Application: Apply Now, 3-4 Months of Business Bank Statements, A Voided Business Bank Check and A Driver License. You'll Get A Merchant Cash Advance In 30 Minutes. Funds Will Be Submitted To Your Bank Account The Same Day You're Approved. You'll Need To State On Application That You Want To Consolidate Your Existing MCAs. We'll Consolidate Your Existing Daily, Weekly or Monthly Merchant Cash Advance Payments Into One Low Monthly Payment, Regardless Of The Number Of Existing Or Merchant Cash Advances You Currently Have. In Some Cases, We'll Consolidate and Pay Off Your Existing Merchant Cash Advances and You'll Still Need To Make Payments Without Receiving Additional Funding. We'll Combine Your Daily, Weekly Or Monthly Payments Into One Low Monthly Payment. If Not Consolidating, You Could Get A New Merchant Cash Advance The Same Day and Funds Will Be Deposited Into Your Bank Account! Upon Approval; You'll Need To Provide Your Payoff Letter(s) From Your Existing Merchant Cash Advance Companies For Your Existing, Outstanding, Debt. We'll Apply Your Approved, Net Funded Amount To This Outstanding Debt(s), And You'll Receive The Difference (Net Proceeds). This Net Proceed Amount Needs To Equal 30%-50% Of The Merchant Cash Advance Amount. If approved, your Merchant Cash Advance will be deposited into your bank account the same day or within 36-48 hours! It's a quickly funded Merchant Cash Advance issued the same-day (depending on time-of-day you submit your application. Remember, Apply Now, Fill-in The Application, Upload Drivers License or State Issued ID; A Business Voided Check and 3-4 Months Of Business Bank Statements. Also, State On Application That You Need Money For Working Capital, Equipment Financing, Hard Money and Bridge Financing.

Merchant Cash Advance (MCA) with Credit Card Processing Statements

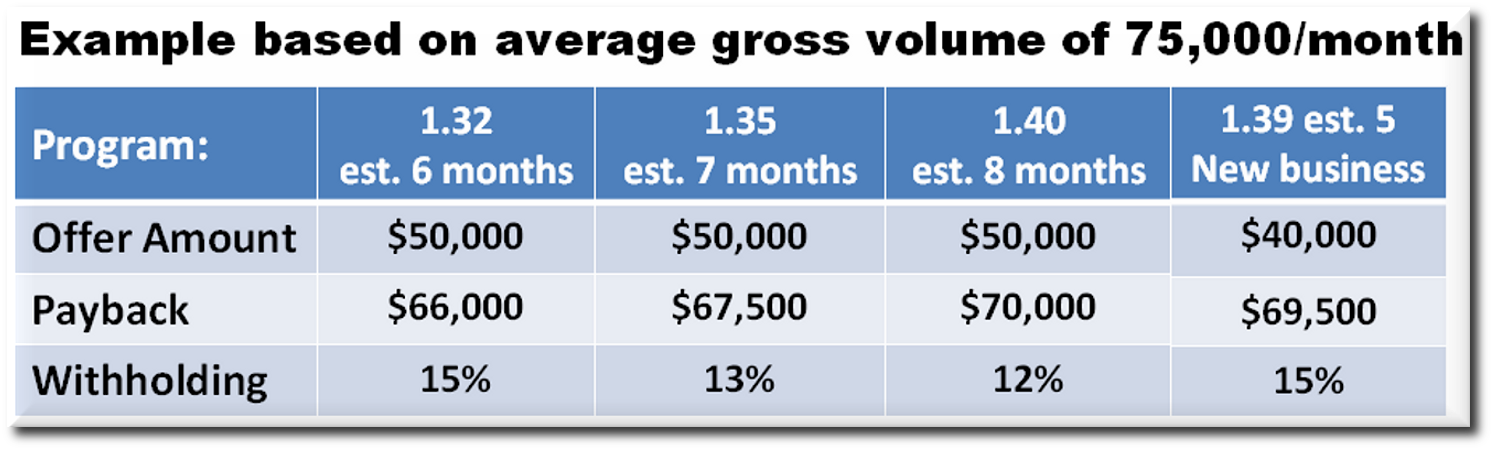

A Merchant Cash Advance (MCA) with Credit Cards Processing Statements is based off of a business’ monthly credit/debit card sales. We are buying a merchant’s future credit/debit card sales today at a discount. We advance them $X for the right to buy back $Y worth of their future credit/debit card sales. We do this by taking a small % of their future credit/debit card sales going forward until the advance is paid off. We typically pay 74¢ for each future credit/debit card receivable purchased. If approved, your Merchant Cash Advance will be deposited into your bank account the same day or within 36-48 hours! It's a quickly funded Merchant Cash Advance issued the same-day (depending on time-of-day you submit your application.

We typically will advance up to one months worth of a merchant’s credit card receivables (or roughly 100% of their monthly volume). The amount advanced ultimately is based upon not only the merchant’s credit card sales, but also their overall total sales.

We don’t hamper your business’ growth with an MCA. To protect the merchant’s cash flow, we like to take less than 20% of a merchant’s future credit card sales until we’ve collected the amount of future credit/debit card receivables purchased. And as an additional safeguard to the merchant, we will not take out more than 10% of the business’ total gross sales.

Higher approval rates than traditional finance products. MCA is for you when you can’t get a loan from a bank. There’s no fixed monthly payments since an MCA works with your business’ cash flow and credit card sales. Fill-in This Application, Upload Drivers License or State Issued ID; A Business Voided Check and BOTH 3-4 Months Of Business Bank Statements AND 3-4 Months Of Credit Card Procesing Statements.

MCA with Bank Statements

MCA with Credit Card Processing Statements